(The text below is reprinted from the news release by STRS)

Retirement Board Chair, Vice Chair Named

During its June meeting, the State Teachers Retirement Board elected contributing teacher member Mark Hill (Worthington City Schools, Franklin County) as its vice chair for the coming year. According to Board Policies, retired teacher member Robert Stein, who is currently serving as vice chair, automatically moves into the position of chair. Stein and Hill will assume their new responsibilities on Sept. 1, 2016. Board members receive no compensation for serving on the board other than reimbursement for actual, necessary expenses.

Retirement Board Approves Health Care Premiums for 2017

The Retirement Board approved 2017 premiums for all plans offered through the STRS Ohio Health Care Program. A complete list of these premiums is available here, or can be obtained by calling STRS Ohio’s Member Services Center toll-free at 888‑227‑7877. Additional information about the 2017 Health Care Program will be provided in upcoming newsletters and on the STRS Ohio website. In late October, all eligible benefit recipients will receive personalized health care plan information in preparation for the fall open-enrollment period that extends from Nov. 1–22, 2016.

When determining premiums, the Retirement Board and STRS Ohio staff consider the claims experience of plan enrollees, as well as annual health care cost trend rates. The 2017 premium subsidy will reflect a reduction in the years-of-service multiplier for non-Medicare plan enrollees to 1.9% per year of service. This means retirees with 30 or more years of service who are not enrolled in Medicare will receive a premium subsidy of 57% in 2017.

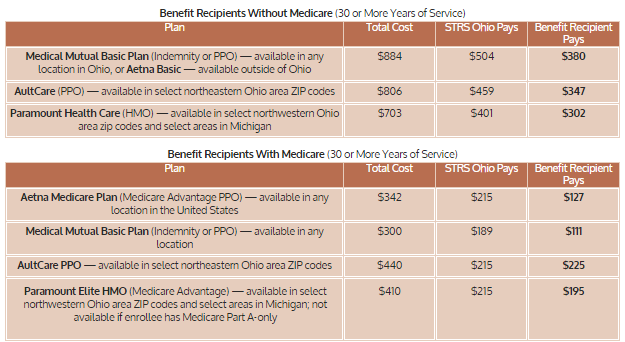

Below is a sample of monthly premiums for calendar year 2017 for a benefit recipient with 30 or more years of service.

During its June meeting, the State Teachers Retirement Board elected contributing teacher member Mark Hill (Worthington City Schools, Franklin County) as its vice chair for the coming year. According to Board Policies, retired teacher member Robert Stein, who is currently serving as vice chair, automatically moves into the position of chair. Stein and Hill will assume their new responsibilities on Sept. 1, 2016. Board members receive no compensation for serving on the board other than reimbursement for actual, necessary expenses.

Retirement Board Approves Health Care Premiums for 2017

The Retirement Board approved 2017 premiums for all plans offered through the STRS Ohio Health Care Program. A complete list of these premiums is available here, or can be obtained by calling STRS Ohio’s Member Services Center toll-free at 888‑227‑7877. Additional information about the 2017 Health Care Program will be provided in upcoming newsletters and on the STRS Ohio website. In late October, all eligible benefit recipients will receive personalized health care plan information in preparation for the fall open-enrollment period that extends from Nov. 1–22, 2016.

When determining premiums, the Retirement Board and STRS Ohio staff consider the claims experience of plan enrollees, as well as annual health care cost trend rates. The 2017 premium subsidy will reflect a reduction in the years-of-service multiplier for non-Medicare plan enrollees to 1.9% per year of service. This means retirees with 30 or more years of service who are not enrolled in Medicare will receive a premium subsidy of 57% in 2017.

Below is a sample of monthly premiums for calendar year 2017 for a benefit recipient with 30 or more years of service.

CEM Ranks STRS Ohio First in Member Service

CEM Benchmarking, a leading global benchmarking company, reviewed with the board the results of its Pension Administration Benchmarking report for fiscal year 2015. STRS Ohio was benchmarked against 53 leading global pension systems from the United States, Canada, Denmark, The Netherlands, Scandinavia and the United Arab Emirates that serve more than 25 million active members and annuitants. STRS Ohio’s service level score was the highest among all participants, and the Call Center also ranked first among all participating systems.

The CEM study also measures systems’ costs to provide service. STRS Ohio’s cost per member was higher than the average system cost for its 14-member peer group in fiscal 2015, but the study noted that STRS Ohio’s costs have trended lower since 2012, while the average costs for the peer group trended higher during this time frame.

CEM Benchmarking, a leading global benchmarking company, reviewed with the board the results of its Pension Administration Benchmarking report for fiscal year 2015. STRS Ohio was benchmarked against 53 leading global pension systems from the United States, Canada, Denmark, The Netherlands, Scandinavia and the United Arab Emirates that serve more than 25 million active members and annuitants. STRS Ohio’s service level score was the highest among all participants, and the Call Center also ranked first among all participating systems.

The CEM study also measures systems’ costs to provide service. STRS Ohio’s cost per member was higher than the average system cost for its 14-member peer group in fiscal 2015, but the study noted that STRS Ohio’s costs have trended lower since 2012, while the average costs for the peer group trended higher during this time frame.

Board Accepts Fiscal Year 2017 Investment Plan

The Retirement Board voted to accept the fiscal year 2017 Investment Plan presented by staff. The plan details staff investment strategy for each asset class in the system’s investment fund. The 2017 Investment Plan calls for modest growth in the capital markets.

The Retirement Board’s investment consultants, Callan Associates and Cliffwater LLC, reviewed and expressed support for the Investment Plan. Staff will evaluate the need to issue an addendum to the Annual Investment Plan once market levels are set on June 30, 2016. STRS Ohio will post the fiscal year 2017 Investment Plan on its website in early July. A copy of the plan is also available by request through STRS Ohio’s Member Services Center, 888‑227‑7877 (toll-free).

Retirements Approved

The Retirement Board approved 271 active and 85 inactive members for service retirement benefits.

Fiscal Year 2017 Budgets Adopted

The Retirement Board adopted the proposed budgets for fiscal year 2017 (July 1, 2016–June 30, 2017). The fiscal 2017 operating budget totals $96.9 million, an increase of 1% over the amended fiscal 2016 budget. The adopted capital budget for fiscal year 2017 totals $3.25 million, an increase of 3.5% over the current year budget.

The board also approved an amended budget request for the current fiscal year for an additional $900,000. Savings identified by various departments were offset by higher than projected costs for performance-based incentive payments, unused vacation and sick leave due to retirement payouts, custodial banking fees and building maintenance and equipment. The Board voted to adopt the budgets effective June 24, 2016.

Board Adopts Updates to Strategic Goals

The board adopted updates to STRS Ohio’s Strategic Goals document that executive director Michael Nehf presented in May. The changes include adding a new strategic goal to address STRS Ohio’s health care funding challenges, as well as adding a new objective to address business continuity and disaster recovery capabilities.

Other STRS Ohio News

STRS Ohio earns GFOA Certificate of Achievement for its Comprehensive Annual Financial Report

STRS Ohio recently learned that its Comprehensive Annual Financial Report (CAFR) for fiscal year 2015 qualified for the Government Finance Officers Association’s (GFOA) Certificate of Achievement for Excellence in Financial Reporting. STRS Ohio has received the award each year since 1990. Staff consolidates financial, investment, actuarial and statistical information into one publication that meets the standards established by the GFOA to receive this recognition.